There are plenty of reasons why donors choose to give to nonprofits. They might support your cause or believe in your mission statement. Some might donate for moral reasons or just to leave a legacy. However, a primary reason that many donors choose to give to nonprofits: their donations are tax-deductible.

In general, nonprofits listed as 501(c)(3) tax-exempt organizations that are formed in the United States are able to receive tax-deductible charitable contributions. This allows charitable organizations to stretch their donations further and make more of a difference in their communities. Organizations have to be exempt when they receive the contribution if they want to ensure that donations are deductible for their donors.

What is a Donation Receipt/Tax Receipt?

A Donation Receipt, sometimes called a tax receipt, is a formal written statement from a qualifying nonprofit which acknowledges they received a donor’s donation. Donors get this receipt as official proof of the contributions they’ve made throughout the year. It’s a vital document that’s needed for donors to write off their contributions when it’s time to file taxes.

In fact, your donors cannot claim a tax deduction for any single contribution of $250 or more, unless they’ve received a written acknowledgment of that contribution from your organization! That’s a crucial piece of documentation your donors need. Without receipts, your top-dollar donors will be unable to write off their contributions, making them much less likely to donate again in the future.

Most nonprofits issue their receipts yearly. Just remember one rule: all donations should be getting a donor receipt–no matter how frequent.

Are there official requirements for donation receipts?

Donation receipts can take on a variety of forms. They can be letters sent to donors, formal receipts, or computer-generated messages. The key distinction to make is that without an official written acknowledgment, donors can’t claim a tax deduction for their donation. The IRS has made no official requirement for what your receipts look like, but they must contain some crucial pieces of information.

Whatever form you choose, the IRS has six items that must be included in your donation receipt:

- Name of the organization;

- Amount of cash contribution;

- Description (but not value) of non-cash contribution;

- Statement that no goods or services were provided by the organization, if that is the case;

- Description and good faith estimate of the value of goods or services, if any, that organization provided in return for the contribution; and

- Statement that goods or services, if any, that the organization provided in return for the contribution consisted entirely of intangible religious benefits, if that was the case.

(From IRS.gov “Charitable Contributions – Written Acknowledgments)

How RoundUp App Handles Donation Receipts

Creating donation receipts can be a headache. There are plenty of pieces of software that automatically craft receipts, or provide helpful workflows for nonprofits. Nonprofits using RoundUp App or Ribbon will automatically have receipts generated for their users. It’s one way we’re helping make it even easier for nonprofits to connect with their donors.

We offer multiple types of receipts, depending on the type of donation your donors make.

- One-time donors will get a donation receipt immediately after donating.

- Monthly donors will get a receipt upon monthly processing.

- RoundUp donors will get a donation receipt after processing.

- Yearly donation receipts will be available for all donors in January.

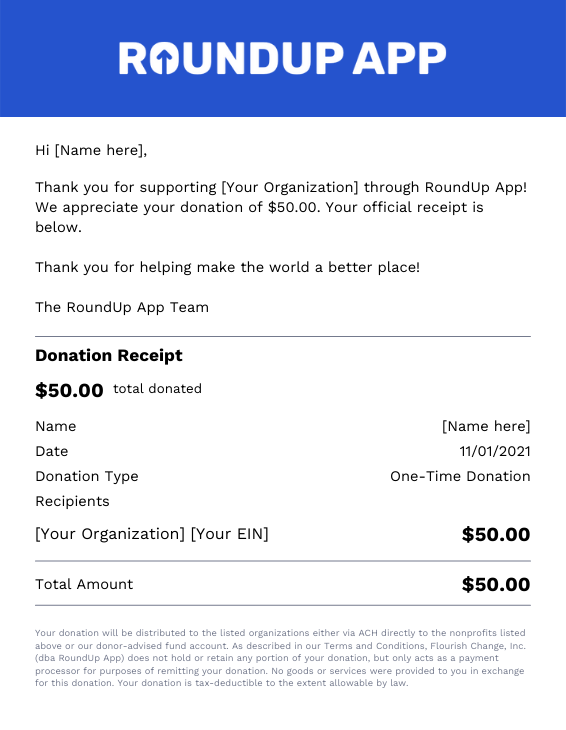

Here’s a sample of what your donation receipt will look like for donors donating through RoundUp App:

How To Access Your Donation Receipts in the RoundUp App as a Nonprofit

Nonprofits using RoundUp App don’t have to do anything to start sending or accessing receipts. We automatically send these to your donors based on the type of donation they make. Regardless of donation type, all donors who have sent in a donation during the current fiscal year will receive a yearly donation receipt collecting all of their donations for the year.

Sending Yearly Donation Receipts Helps Your Donors

One of the best ways to maintain a positive donor relationship is to show them how much of an impact they’ve had this year. While it’s possible to send a Donation receipt for each and every donation a donor makes to you, it’s generally the best practice to provide one receipt one time a year.

This receipt collects all of the donations your donor has made throughout the year. By doing this, you’re making it super easy for your donor and not forcing them to track down a year’s worth of monthly receipts.

It’s also a great way to remind your donors that their donations are tax-deductible. Many nonprofits choose to send their receipts for the year prior to January 31st of the following year. This gives your donors plenty of time to collect and prepare their taxes. Here at RoundUp App, we’ll send one-time, monthly, and yearly donation receipts to all of your donors depending on their donation schedule.

In conclusion, receipts are a vital part of the documentation process and donor engagement process. Work donation receipts into your process to ensure all your donors are able to deduct their donations.